|

|

Books by and about 2020 presidential candidates |

|

Crippled America,

by Donald J. Trump (2015) |

Fire and Fury,

by Michael Wolff (2018) |

Trump Revealed,

by Michael Kranish and Marc Fisher (2016) |

The Making of Donald Trump,

by David Cay Johnston (2016) |

Promise Me, Dad ,

by Joe Biden (2017) |

The Book of Joe ,

by Jeff Wilser (2019; biography of Joe Biden) |

The Truths We Hold,

by Kamala Harris (2019) |

Smart on Crime,

by Kamala Harris (2010) |

Guide to Political Revolution,

by Bernie Sanders (2017) |

Where We Go From Here,

by Bernie Sanders (2018) |

Our Revolution,

by Bernie Sanders (2016) |

This Fight Is Our Fight,

by Elizabeth Warren (2017) |

United,

by Cory Booker (2016) |

Conscience of a Conservative,

by Jeff Flake (2017) |

Two Paths,

by Gov. John Kasich (2017) |

Every Other Monday,

by Rep. John Kasich (2010) |

Courage is Contagious,

by John Kasich (1998) |

Shortest Way Home,

by Pete Buttigieg (2019) |

Becoming,

by Michelle Obama (2018) |

Higher Loyalty,

by James Comey (2018) |

The Making of Donald Trump,

by David Cay Johnston (2017) |

Trump vs. Hillary On The Issues ,

by Jesse Gordon (2016) |

Outsider in the White House,

by Bernie Sanders (2015) |

|

|

Book Reviews |

(from Amazon.com) |

(click a book cover for a review or other books by or about the presidency from Amazon.com)

|

JFK and the Reagan Revolution

A Secret History of American Prosperity

by Lawrence Kudlow & Brian Domitrovic

(Click for Amazon book review)

BOOK REVIEW by OnTheIssues.org:

The late economist Paul Samuelson is credited with the quip that the stock market has predicted nine of the past five recessions. Like history and political science, economics is a fact-based discipline where the agenda of the person or persons presenting the evidence can shade the conclusions reached. Such is the case with JFK and the Reagan Revolution: A Secret History of American Prosperity, a 2016 volume in which economist Lawrence Kudlow and historian Brian Domitrovic look at the American economy of the 1960s through the filter of supply-side economics, and try to claim President John F. Kennedy as a Reaganesque tax cutter.

Kudlow is primarily known as a television personality, currently on FOX but previously with CNBC. During the Trump administration he served as the Director of the National Economic Council. And what he was known best for during those years was making pronouncements that time and again proved wrong.

In February 2020 as COVID-19 was turning into a worldwide pandemic, he went on CNBC and declared, "We have contained this. I won't say [it's] airtight, but it's pretty close to airtight." By June he made one of the worst predictions on the spread of the illness, "There is no second wave coming. It's just hot spots." (CNBC, June 6, 2020). He didn't fare better on his economic predictions as in a July 2020 claim "I still think a V-shaped recovery is in place" something that was belied by the massive number of business closures and unemployment claims in the following year (Business Insider, July 2020).

So take anything from Kudlow with a grain of salt. His thesis in this volume is that Kennedy came around to thinking that the way to jump-start the economy was not government spending but cutting tax rates. These cuts were signed into law by Lyndon Johnson in 1964, who assumed office after Kennedy's assassination. These led to economic boom times in the 1960s, and Kudlow later compares that to Reagan supposedly doing the same thing and getting the same result. He and his-coauthor – a senior associate at the Laffer Center at the Pacific Research Institute – conclude that this vindicates supply-side economics and economist Arthur Laffer, who came up with the "Laffer curve" that supposedly showed that cutting taxes increased government revenues.

It's true only if you ignore the significant differences between the tax rates in the early 1960s, when Kennedy's cuts went into effect, and the rates under Reagan. In 1962 the top marginal rate was 91%, and Kennedy wanted it reduced to 65%. The comparable corporate rates were 52% and 47%. Kennedy's supposed "supply-side" rates are much higher than anything on the books today. (The 2017 Trump tax cuts, for example, cut corporate rates to 21%, and Republicans are objecting to President Biden's proposal to increase it to 28%.) So Kudlow and Domitrovic are trying to force a square peg into a round hole.

The volume is interesting if you're looking to discover how tax and economic policy was debated sixty years ago, with quotes from Kennedy's speeches, Congressional hearings, and Wall Street Journal editorials, but in terms of making the case that Kennedy was an early supply sider, it carries as much weight as Kudlow's COVID predictions, which is to say, none at all.

-- Daniel M. Kimmel, editor, OnTheIssues.org, May 2021

Economic policy analysis below

| OnTheIssues.org excerpts: (click on issues for details)

|

Budget & Economy

Jimmy Carter: 1980s: Limited bank lending & money supply.

John F. Kennedy: Moving away from New Deal means tax cuts & strong dollar.

Larry Kudlow: Idea of America without economic growth is preposterous.

Larry Kudlow: Tax cuts mean more revenue; more cuts curtail government.

Larry Kudlow: Inflation & high tax rates led to "stagflation".

|

Civil Rights

Larry Kudlow: Segregationists connected tax reform & civil rights.

|

Corporations

Larry Kudlow: Tax cuts led to new investment & business start-ups.

Larry Kudlow: Stock market is a leading indicator of economic trends.

|

Homeland Security

Noam Chomsky: 1960s tax surcharge was a "war tax" to sponsor Vietnam war.

|

Jobs

Janet Yellen: Inflation and unemployment are inversely connected.

|

Principles & Values

Larry Kudlow: Prosperity an essential component of American identity.

|

Tax Reform

George Bush Sr.: Voodoo economics: 30% tax rate cut causes 30% inflation.

John F. Kennedy: 1961 tax cuts inspired 1985 closing of tax loopholes.

Larry Kudlow: Liberals act as if tax rate cuts are far right policies.

Larry Kudlow: Enormously high tax rates in 1950s impacted everyone.

Larry Kudlow: Progressive tax code ensured frequent economic slowdowns.

Larry Kudlow: Progressive taxation makes it less profitable to succeed.

Larry Kudlow: Supply-side economics: tax rate cuts & sound dollar.

Lyndon Johnson: Raised income tax with 10% surcharge.

Ronald Reagan: Abhorred high tax rates due to negative incentive on wealthy.

Ronald Reagan: As CA governor, made tax system more progressive.

Ronald Reagan: Bracket creep reduces deficit when there's inflation.

|

Technology

Larry Kudlow: Technological innovations can transform business & society.

Larry Kudlow: Hard to imagine Silicon Valley start-ups without tax cuts.

|

The above quotations are from JFK and the Reagan Revolution

A Secret History of American Prosperity

by Lawrence Kudlow & Brian Domitrovic.

ECONOMIC ANALYSIS by OnTheIssues.org:

The "Laffer Curve" is the core of Larry Kudlow's book, and is also the core of both JFK's and Reagan's tax policy. Kudlow's book also includes core misrepresentations about the Laffer Curve and about Reagan's tax policy -- we separate out the facts from the misrepresentations below. Those misrepresentations have become standard conservative dogma, from the Reagan era through the Trump era, so understanding their basis is important for determining tax policy in the future.

There are numerous aspects of the Laffer Curve which are accepted as standard economic facts; we'll try to explain this complicated issue with clear facts and simple numbers first:

- Laffer Curve:

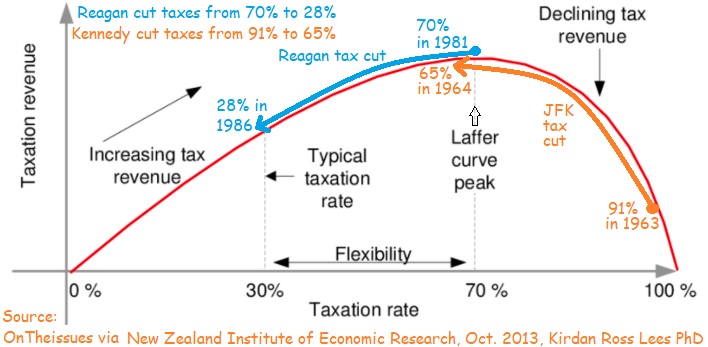

The Laffer Curve presented below shows the total tax revenue expected versus the top marginal tax rate (which means the tax percent on the last dollar earned). That means that raising the percentage of income paid by the wealthiest earners does not necessarily increase the amount that wealthy taxpayers actually pay.

- Laffer Peak:

The "Laffer curve peak" represents the maximum revenue -- at about 65% or 70% tax rate -- economists argue about the exact shape of the curve and the exact point of the peak, but everyone agrees that there is a peak around that tax rate.

- Revenue decrease when raising rates above the peak:

When the marginal tax rate exceeds the "Laffer curve peak", total revenue decreases. That means that a wealthy person will pay less in total tax when the top marginal rate is 90%, than when the top marginal rate is 70%. That's because a marginal tax rate of 90% encourages finding tax loopholes and tax shelters -- that's the central idea of the Laffer Curve -- at somewhere around 65% or 70% marginal tax rate, the incentives to avoid tax outweigh the incentives to earn more income.

- Revenue increase when raising rates below the peak:

When the marginal tax rate is below the Laffer curve peak, raising the marginal tax rate increases revenue. That's what the label "Increasing tax revenue" means on the chart. For example, with a marginal tax rate of 30% (well below the Laffer curve peak), a wealthy earner would pay $300,000 tax on the highest million dollars of earnings. With an increase of the marginal tax rate to 50%, (still below the Laffer curve peak) a wealthy earner would have $500,000 tax due on the highest million dollars of earnings, which would increase total revenue by $200,000. The label "Flexibility" in the range 30% to 70% means that the government can choose any marginal tax rate in that range and expect more revenue with higher tax rates.

- Example of declining tax revenue:

When the marginal tax rate exceeds the Laffer curve peak, raising the marginal tax rate decreases revenue. That's what the label "Declining tax revenue" means on the chart. For example, with a marginal tax rate of 60% (just below the Laffer curve peak), a wealthy earner would pay $600,000 tax on the highest million dollars of earnings. With an increase of the marginal tax rate to 90%, a wealthy earner would seem to have $900,000 tax due on the highest million dollars of earnings, which would seem to increase total revenue by $300,000. But because that marginal tax rate is so high, that wealthy earner would seek tax shelters, and end up paying, say, $500,000 tax, a net revenue loss of $100,000 instead of any increase in revenue.

- Tax shelters:

The exact details of the available tax shelters determines the exact point of the Laffer curve peak, and the exact shape of the curve too. That's why economists argue about the details of the peak and the shape -- but the basic idea is that there IS a peak, and revenue falls above that peak because of tax shelters. Many politicians focus on "closing tax loopholes" -- which means "making it harder for high income earners to avoid paying high taxes" -- those can change the peak and shape a little, but the basic idea of the Laffer Curve stays intact -- which means other loopholes will always get found.

- Kennedy and Laffer?:

JFK and his advisers never called this the "Laffer curve," as Reagan's advisers did -- because economist Arthur Laffer only popularized that term in 1974. But the idea behind the Laffer curve is much older than that -- decades or centuries old, as Laffer documented -- and was well-understood and well-accepted by Kennedy's advisers as well as Reagan's.

Now here's where underlying facts change to policy. We'll try to summarize what Kudlow and other Reagan supporters say which is fact, and which is political opinion and whether those opinions are misrepresentations of economic reality or not:

- Kennedy tax cuts:

The tax cuts proposed by President Kennedy in 1963 cut the marginal tax rate from 91% to 65%. The old rate of 91% was well above of the Laffer curve peak; and the proposed rate was right at the Laffer curve peak. In other words, the intent was to maximize revenue by removing the incentive for wealthy people to avoid taxes.

- Did Kennedy cuts work?:

Did the Laffer Curve predict the outcome of the Kennedy tax cuts? Yes, total tax revenue increased from 1964 to 1965, as predicted by the Laffer Curve. That same period saw a drop in unemployment from 5.2% to 4.5% and an increase in consumption and investment, which are not predicted by the Laffer Curve but which President Kennedy promised as the desired outcome. President Johnson coupled the tax cuts with spending increases on Medicaid and other Great Society programs -- in other words, the extra tax revenue went into stimulus programs -- which many attribute as the reason for the overall economic growth.

- Reagan tax cuts:

The tax cuts proposed by President Reagan in 1980 to 1986 cut the marginal tax rate from 70% to 28%. The old rate of 70% was near the Laffer curve peak; and the proposed rate was well below the Laffer curve peak. In other words, the intent was to reduce the marginal tax rate, not to maximize revenue (further discussion of intent and results below).

- Did Reagan cuts work?:

Did the Laffer Curve predict the outcome of the Reagan tax cuts? Yes, but it's a more complicated answer than with Kennedy. From 1980 to 1990, total tax revenue as a percentage of GDP decreased (from 18.5% to 17.4%) -- that is the core prediction of the Laffer Curve, but it really only predicts that result for high earners who pay the top marginal tax rate. In that same period, total federal tax revenue doubled -- which means that the wealthy paid a much lower share than moderate earners, as the Laffer Curve implies. Reagan's detractors call that "growing wealth inequality" and Reagan's supporters call that "increasing the supply side" or today "rewarding the job creators." Reagan tripled the annual budget deficit -- which means that, like President Johnson, Reagan increased spending (albeit on defense, not on social programs). Hence Reagan's tax cuts were an economic stimulus, cutting both inflation and unemployment (which was Reagan's goal: to beat "stagflation"); and also cutting the poverty rate while increasing average family income (which was Johnson's goal, but not Reagan's).

Now here's where policy options change to political opinion. And where Kudlow is simply misrepresenting facts and policy -- and where Kudlow is representative of the supply-side movement.

- Liberals do cut tax rates, but Kennedy did so for different reasons than Reagan: Kudlow writes "Today's liberals and progressives act as if tax rate cuts... are shockingly far-right policies" (p. 7). That assertion is true, but Kudlow misapplies it. Liberals and progressives are more concerned with the distribution of taxes than the tax rates. Kennedy's tax rate cuts redistributed the tax burden to increase the share paid by the wealthy, and to decrease the share paid by the non-wealthy. Reagan's tax rate cuts redistributed the tax burden to DEcrease the share paid by the wealthy, and to INcrease the share paid by the non-wealthy -- THOSE are the "shockingly far-right policies" today, not the tax rate cuts themselves.

- The marginal tax rate matters when cutting tax rates: Kudlow writes that the Kennedy "administration's case for tax cuts... flows from the fact that progressive taxation makes it less and less profitable to succeed" (p.103). That statement is true when above the Laffer curve peak (as for Kennedy), but false when below the Laffer curve peak (as for Reagan) -- that is what the Laffer Curve is all about!

- The real purpose of Reagan tax cuts was to shrink government programs: Kudlow writes that "the 1964-1965 revenue obtained from the tax cut would have easily overwhelmed government outlays... Taxes must continue to be cut, lest the government get large." (p. 161). President Johnson used the Kennedy tax cut revenue to create the "Great Society" -- Johnson had no issue with "the government getting large." That's a Republican issue, and is the core reason that Reagan wanted his tax cuts -- to "starve the beast" of social program spending.

That's our analysis -- it's enough to give readers a full understanding of Laffer economics -- while Kudlow's book gives only one side of the argument.

-- Jesse Gordon, editor-in-chief, OnTheIssues.org, May 2021

|